Starting from January 2024, changes to Malaysia's import sales tax will be implemented.

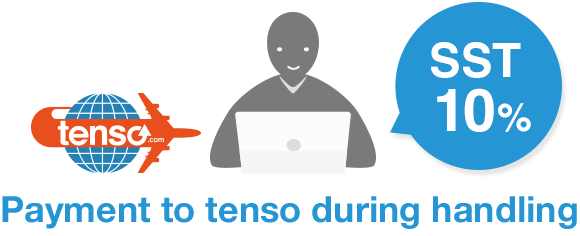

Due to the above changes, a 10% Sales & Service Tax (SST) will be imposed on packages imported into Malaysia after Aug 27, 2024.

For more details, please refer to the Malaysian Ministry of Finance's press release.

You will have to pay the SST of 10% of the item price.

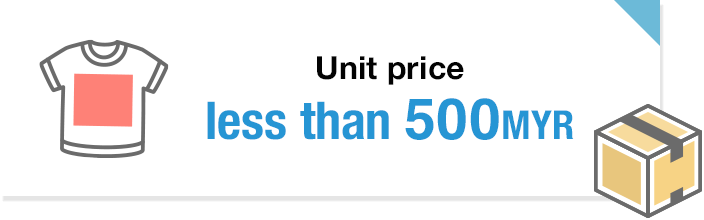

The determination of whether the contents are more or less than 500 MYR will be based on the stated invoice amount (in JPY) and converted at our exchange rate.

If you have paid the SST of 10% of the items under 500 MYR when arranging shipping, but you are charged by the shipping company again for the same items at the time of delivery, please send the payment receipt to tenso customer support.

The SST mentioned above is related to import sales tax, and there are no changes regarding import duties.

If customs duties are incurred during importation, they will be charged by the shipping company when the package is delivered.

* Regardless of the shipping method, SST will be collected in advance for packages shipped to Malaysia.

We apologize for any inconvenience these changes may cause you. Thank you for your understanding.